Capital Formation in Web3: A Comparative Study of Token Launchpads

An in-depth evaluation of leading launch platforms for Web3 builders and capital allocators

In traditional startup ecosystems, raising capital is often a prolonged and resource-intensive process, it involves venture capital negotiations, formal pitch decks, audits, legal reviews, and multi-stage approvals.

In contrast, the crypto economy, especially within the Solana ecosystem has radically faster and more open model of fundraising. Early-stage teams now have the ability to raise meaningful capital in days or even hours, through mechanisms such as public token sales, liquidity bootstrapping pools, and most notably, launchpads.

On Solana, these platforms have become a core infrastructure layer: helping founders distribute tokens, activate early liquidity, and kickstart network effects with speed and transparency.

This shift is not just about pace and accessibility. It reflects a deeper transformation in the principles of capital formation: open by default, global in reach, and increasingly pseudonymous in nature.

This deep dive focuses on the launchpad ecosystem within Solana. How these platforms work, who they serve, and what both founders and investors must understand before engaging with them.

We begin with a brief overview of how crypto fundraising has evolved, laying the foundation for why launchpads became necessary. But the heart of this work is a comparative analysis of the most prominent Solana-native launchpads, examining their technical design, token distribution mechanics, governance models, and user experience.

By evaluating their strengths and trade-offs from both a builder’s and investor’s perspective, this report aims to serve as a practical guide to navigating Solana’s fast-evolving launch infrastructure.

Though the subject matter touches on protocol-level mechanics and financial design, every idea is presented with clarity, ensuring that whether you’re crypto-native or just Solana-curious, you can engage with this landscape meaningfully.

Chapter 1: Introduction

The First Crypto Fundraising Event and ICO boom

The origins of crypto-based fundraising date back to July 2013, when a project named Mastercoin conducted the world’s first token sale, a now-retrospectively-termed ICO. Led by J. R. Willett, Mastercoin issued its tokens to early supporters simply by asking them to send bitcoins to a designated wallet address, all coordinated via a post on the Bitcointalk forum. This unorthodox and minimally structured fundraiser attracted around 4,700 BTC (equivalent to approximately $500,000 at the time). Though the term “ICO” had not been coined yet, this event laid the groundwork for crypto’s earliest attempts at decentralized capital formation.

This unstructured approach inspired what would become a watershed moment: Ethereum’s ICO in 2014. Backed by smart contracts that automated token distribution and escrow, Ethereum raised over 31,000 BTC (roughly $18 million), signaling the potential of programmable fundraising. The success of Ethereum catalyzed the ICO boom of 2017–2018, where billions were raised across thousands of projects, many of them with little more than a whitepaper and a website.

But the hype came with a cost.

The Post-ICO Reality Check

As speculative mania peaked, quality declined. A wave of low-effort or fraudulent projects entered the market, pushing token valuations to unsustainable levels. By early 2018, the ICO bubble burst. Billions were wiped out, and investor confidence was shaken. The failure exposed key issues in the model: minimal investor protections, poor project vetting, regulatory risk, and capital inefficiency.

This chart shows a value-weighted index of digital assets, normalized to 100 in January 2015. The vertical dashed line marks the burst of the ICO bubble in early 2018. From late 2017 to early 2018, the market saw an exponential surge in token valuations driven largely by speculative investment and the proliferation of low-quality projects. This unsustainable growth culminated in a sharp correction, wiping out billions in market capitalization and exposing critical flaws in the ICO model: lack of investor protection, poor project due diligence, and regulatory uncertainty.

As the ICO wave crashed, the industry began to explore more structured fundraising models:

Initial Exchange Offerings were among the first structured alternatives. Conducted via centralized exchanges, IEOs shifted the burden of curation and distribution to the exchange itself. This introduced an added layer of trust and visibility, but at the cost of decentralization, high listing fees, and limited transparency for both investors and teams.

Security Token Offerings sought to align with traditional financial regulations by offering tokens that represented equity, debt, or real-world assets. While they addressed legal uncertainties and investor protection, STOs were burdened by complex compliance requirements and suffered from illiquidity and minimal adoption outside institutional circles.

Fair Launches represented the opposite extreme tokens were distributed entirely to the public with no early access, private rounds, or VC participation. Popularized during the DeFi boom, these launches emphasized community ownership and egalitarian distribution. However, they lacked capital efficiency, were vulnerable to manipulation (e.g., bot attacks), and often failed to provide sufficient runway for teams to build sustainably.

Liquidity Bootstrapping Pools emerged as an innovative mechanism to solve pricing inefficiencies in early token launches. By dynamically adjusting token prices over time, typically through platforms like Balancer, LBPs allowed for more organic price discovery and better Sybil resistance. Despite their advantages, they remained complex for average users and lacked intuitive UX.

Each brought improvements, but also trade-offs. Centralization, complexity, lack of liquidity, and low capital efficiency remained concerns.

This period revealed a critical insight:

The crypto ecosystem didn’t just need new fundraising models. It needed better infrastructure to support and scale them.

The Rise of Launchpads

That gap gave birth to a new category: Launchpads.

Initially popularized on Ethereum and BNB Chain, launchpads introduced a structured, semi-decentralized approach to public fundraising. These platforms helped projects design tokenomics, manage compliance, reach early adopters, and boot liquidity, all while offering curated investment access to retail users.

But perhaps the most significant evolution is now happening elsewhere: on Solana.

With its high-speed execution, low fees, and growing developer mindshare, Solana has become fertile ground for the next generation of launchpads, ones that are not only refining existing models but reimagining the launch stack entirely.

From permissionless fair launches and community DAOs to novel bonding curves and token distribution tooling, Solana-native launchpads are rapidly defining a new fundraising blueprint.

This report follows that frontier.

Chapter 2: Understanding Crypto Launchpads

Before a token can be traded, staked, or integrated into any Solana protocol, it must be launched and launching a token is far from simple. For early-stage founders, especially those building on revolutionary chains like Solana, the process is challenging with technical, legal, and operational complexities. Deploying secure SPL tokens, handling investor onboarding, ensuring fair and trustless distribution, complying with KYC regulations, and activating liquidity on DEXes like Jupiter or Raydium, all while keeping the community informed can be overwhelming.

This is the space where Solana-native launchpads offer their most vital utility: they simplify, secure, and structure token launches for a new generation of projects built on speed, scale, and composability.

The Dual Role of Launchpads

Launchpads play a unique role in the ecosystem by serving two critical constituencies:

Founders, who need reliable infrastructure and distribution channels to get their tokens into the market.

Investors, who seek early access to high-upside projects with transparent structures and potential gains.

For Founders

1. End-to-End Launch Infrastructure

Solana launchpads offer comprehensive tooling for token launches, from audited SPL token contracts and token distribution dashboards to automated vesting contracts and liquidity bootstrapping pools. Founders don’t need to reinvent core mechanics; they can plug into reliable infrastructure.

2. Tokenomics Design & Fundraising Strategy

Many launchpads now offer advisory services for public/private round structuring, vesting schedules, and emission curves. This is especially helpful for first-time founders figuring out the nuances of token engineering on Solana.

3. Compliance & Distribution Handling

From wallet whitelisting and Sybil resistance to automated refund logic and KYC integration, launchpads reduce legal risk while streamlining distribution to qualified buyers, whether through lottery systems, tiered access, or fair launches.

4. Liquidity & Market Activation

Post-TGE, Solana launchpads often help seed liquidity on key venues like Jupiter, Orca, or Raydium. They may also assist with CEX listing prep, Token2022 features, or integrations with aggregator platforms.

For Investors

1. Early Access to High-Potential Projects

Solana’s lower barrier to entry often attracts lean, ambitious teams. Launchpads give investors access to this pipeline while mitigating some of the risk through vetting, community scrutiny, and transparency.

2. Equitable Participation Models

Whether through tiered access, bonding curves, or lottery-based whitelisting, Solana launchpads often experiment with novel mechanisms to reduce gas wars and ensure fairer access, especially important in a chain designed for scale.

3. Transparency in Tokenomics

Most reputable launchpads now require public emission schedules, real-time vesting visibility, and logic dashboards, which is a key to building investor trust in a post-ICO world.

4. UX-First Experience

Solana launchpads benefit from the chain’s low-cost, high-speed design. No failed transactions due to gas wars, no multi-minute confirmation times. Just fast, seamless execution.

Evolving Models Unique to Solana

Solana’s performance capabilities like, low fees, high throughput, composability have not only made it a haven for experimentation but have also fueled the rapid evolution of token launch mechanisms.

As a result, the Solana ecosystem now have a surprisingly wide variety of launchpads, each built around different principles, target users, token models, and visions for decentralization.

Some are permissionless and allow anyone to launch a token with a few clicks. Others are curated, offering full-stack infrastructure, strategy guidance, and deep community access. Some favor retail inclusivity with low capital thresholds, while others cater to power users with token-gated tiers, exclusive pools, and sybil-resistance tooling.

Bonding Curves and Fair Launch Auctions

NFT-gated Sales, SPL staking access, and whitelist raffles

Token Launch-as-a-Service APIs, and even gamified launches involving quests and on-chain reputation

This diversity is exciting, but also overwhelming.

For founders, the question is no longer “Should I use a launchpad?”, it's “Which one aligns with my project’s values, goals, and users?”

The result? A noisy, fast-moving situation filled with options… but little clarity.

That’s exactly what the next chapter addresses.

By diving deep into five of the most prominent Solana-native launchpads, we aim to provide founders and investors with an actionable comparison: what each platform does best, who it’s designed for, and how to choose the one that fits.

Chapter 3: Launchpad Deep-dive

The rise of launchpads on Solana has not led to a standardized playbook. Instead, it has produced a competitive and experimental ecosystem of platforms. Each offering vastly different trade-offs across UX, tokenomics, regulations, and distribution models. For builders and investors alike, choosing the right launchpad can be a decisive factor in a project's success or failure.

This chapter maps out the mechanics behind six of the most active and influential platforms on Solana, each representing a unique approach to token launches. These include Pump.fun, MetaDAO, DAOS.fun, and Solanium.

1. Pump.fun

Platform Overview

Pump.fun is a Solana-based token launchpad launched on January 19, 2024. Founded by Noah Tweedale, Alon Cohen and Dylan Kerler, it was created to simplify the creation and trading of new tokens (especially meme coins) on Solana. The platform’s mission, as described by the founders, was born out of frustration with traditional memecoin trading and the risk of rug-pulls, essentially to make token launches “fun” and easy.

In practice, Pump.fun quickly gained a reputation as “ground zero” for meme coins: virtually anyone can create and immediately swap new tokens. By mid-2025 it had become one of Solana’s most active dApps, with millions of tokens created (over 8–11 million by various estimates) and massive user engagement. It is widely known for its fast growth and unusually high volume (e.g. processing over 71% of daily new token launches on Solana and topping DeFi revenue charts).

Supported Launch Models

Fair-Launch, No Presales: All Pump.fun projects are “fair-launch” by design – there are no private pre-sales or founder allocations. This means every token is created fully open to the public, and its initial supply is sold on-chain rather than pre-distributed.

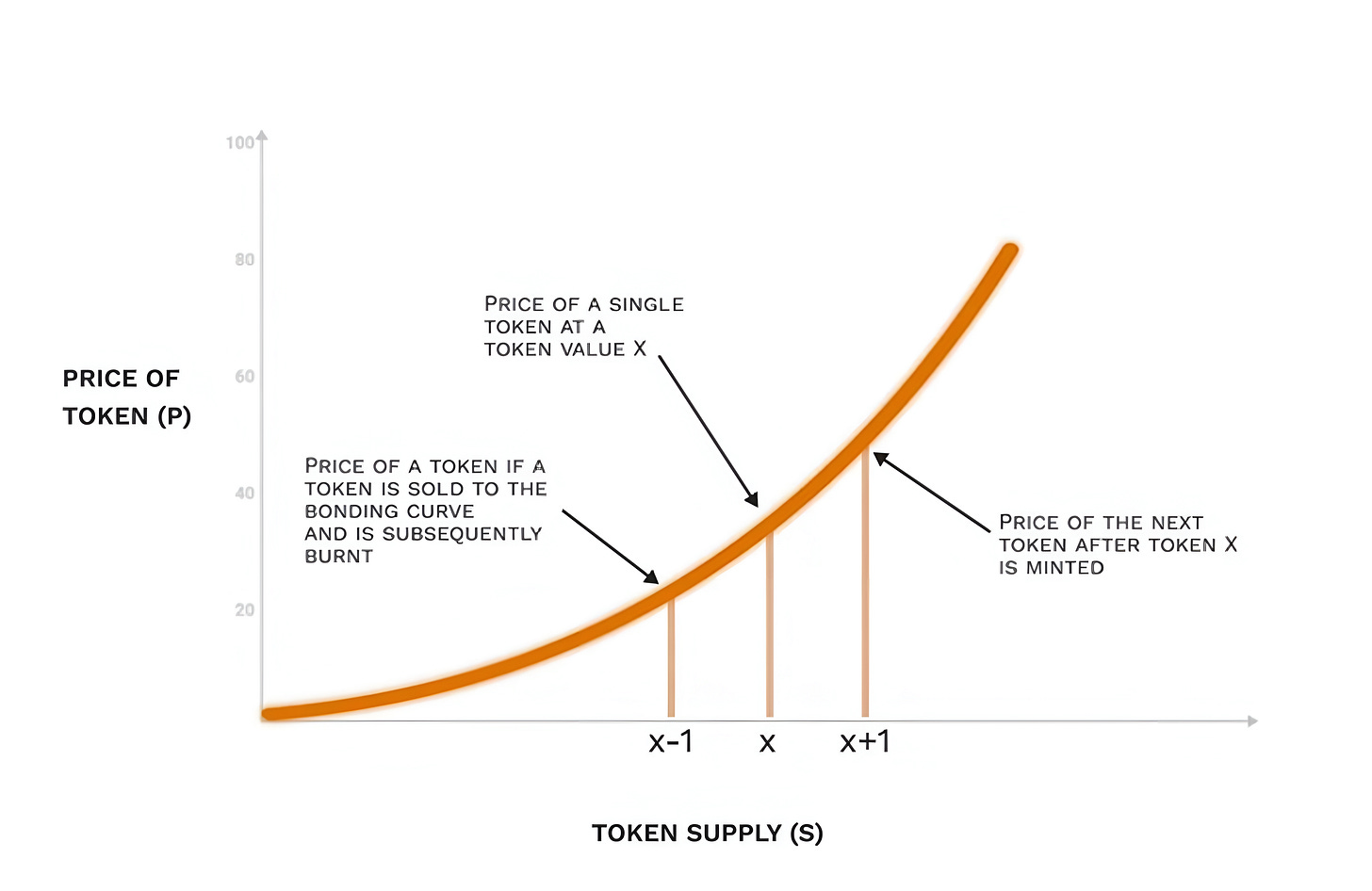

Bonding-Curve Pools: New tokens are launched into a bonding-curve AMM (an automated price-rising pool). When a token goes live, its price starts very low and rises as early investors buy in. This bonding-curve mechanism remove the need for founders to seed liquidity; the token can be traded immediately via the bonding curve.

Credit: Coin98 Meme-Coin Factory: While any type of token can in theory be created, Pump.fun is popularly described as a meme-coin factory. The vast majority of launches have been joke or pop-culture tokens (e.g. “DogWifHat” or “Fartcoin”), since there is no vetting of a project’s utility. In essence, Pump.fun implements a simple, no-code “one-click” token creation model, turning token launches into viral events.

Target Audience

Pump.fun is aimed at anyone who wants to launch a token without red tape. There is no identity requirement – users simply connect a Solana wallet (no KYC is needed). Many founders on Pump.fun are completely anonymous. The platform’s ethos and interface encourage a casual, creative crowd. In fact, its open model has allowed very unlikely founders (even a 13-year-old) to launch and abandon tokens. Since Pump.fun gained traction as a “meme coin factory,” the typical projects launched by founders have been humorously-themed or hype-driven tokens, rather than serious products.

The investor base is overwhelmingly retail and speculator-oriented. Pump.fun’s users tend to be DeFi “degenerate” traders looking for quick flips and viral gains. In late 2024 it accounted for roughly 60% of all new tokens on Solana. and in one November 2024 snapshot it was responsible for ~62% of Solana’s transaction volume. This reflects a huge army of short-term traders and meme-coin enthusiasts. Institutional or conservative investors are generally not the target – the environment is more like a casino on-chain.

Legal & Compliance

Pump.fun operates with minimal formal compliance. There is effectively no KYC/AML barrier; anyone worldwide with a Solana wallet can participate. However, this openness has attracted regulatory scrutiny. In early 2025 Pump.fun was hit with a U.S. class-action lawsuit alleging that its token launches are essentially unregistered securities offerings. Plaintiffs claim the platform used manipulative marketing to entice retail investors into volatile meme coins, resulting in losses. Pump.fun has also faced IP concerns (a cease-and-desist for user-created coins using copyrighted logos) and had its social media accounts temporarily suspended. To date, Pump.fun has no built-in identity checks or investor protections, and analysts have noted this is “fuel to the fire” from a regulatory standpoint. The team has signaled plans to improve security: the proposed Pump token whitepaper, for example, calls for third-party contract audits, multi-signature treasuries, and timelocks.

Access Model

Any user with a Solana wallet address can use Pump.fun – no special staking or membership is required. There is no gating token or whitelist; the interface simply lets you click “Create coin” or browse new tokens. Interaction is entirely wallet-based (accounts are identified only by wallet or chosen nickname). Creators pay a small creation fee in SOL (on the order of a few cents, ~0.05–0.1 SOL) and then immediately list their token on the bonding curve. Traders connect their wallet and can buy or sell tokens instantly at the current curve price. Overall, Pump.fun’s access is ultra-open (anything blocking it tends to be external, e.g. social media bans), making it reachable by a global audience.

Project Vetting Process

There is essentially no vetting of projects before or after launch. Pump.fun does not review, audit or approve token projects. Anyone can deploy any SPL token via the UI; the platform’s only “checks” are its general terms of service and a modest creation fee. (One token-creator livestream became so unruly that Pump.fun briefly paused the feature, but this was content-related, not a token vetting step.) Because 98–99% of tokens on Pump.fun end up being pump‐and‐dumps, the onus of diligence falls entirely on users. In short, Pump.fun is a free-for-all: tokens launch at the creator’s whim, and the community decides their fate on-chain.

Distribution Mechanics

New tokens on Pump.fun are distributed entirely through on-chain bonding curve sales. When a token is created, a smart‐contract pool is opened at a very low initial price. Early buyers set the market: each purchase pushes the price up along the bonding curve, and sellers back down. There is no private sale or allocation phase, it’s “first-come” for everyone once the token goes live. Typically, the token’s creator sells into the curve initially (often by buying in as well) and then other users buy above them as hype builds.

Once a token reaches a threshold (commonly a ~$69,000 market cap, per platform convention), it can be “graduated” off Pump.fun onto a decentralized exchange for open trading. Prior to March 2025 that meant moving liquidity to Raydium (for a ~1.5 SOL fee). In practice however, most coins never graduate: a recent analysis found well over 99% of Pump.fun tokens never hit this threshold, meaning they eventually sell out on the bonding curve and collapse.

In March 2025 Pump.fun launched its own in-house DEX (PumpSwap). Now new tokens can list directly on PumpSwap rather than leaving the platform, and liquidity remains “in-house.” All of a token’s trading, both during the initial curve phase and after graduation uses an AMM model. Notably, Pump.fun removes the SOL paid into a bonding curve from circulation (by locking it into the token’s liquidity pool), effectively burning supply and creating scarcity.

Tokenomics & Vesting Structure

By design, Pump.fun enforces no team allocations or vesting for new projects. Every launched token is fully liquid from day one, since there are no private allocations to founders (no “premint” or reserve). Creators simply decide the token’s supply and parameters when launching, and all tokens enter circulation on the curve. There is no built-in vesting or token sink (unlike launchpads that reserve a portion for the team).

The one token that does have standard vesting is Pump.fun’s own planned governance token, PUMP. According to its whitepaper, 15% of PUMP will go to the team/advisors with a two-year vesting schedule, and other allocations (e.g. a DAO treasury) are locked or distributed over time. But for the memecoins themselves, Pump.fun provides no vesting tools or norms. In fact, the new 50% revenue-sharing model effectively replaces the need for founder sell-offs: instead of dumping tokens, creators earn a cut of trading fees.

UX & Investor Experience

Pump.fun’s interface is straightforward. On the “Board” page, all new tokens are listed (with icons, prices, market caps and small charts) in a manner akin to an imageboard or market feed. Users click a token and trade via their connected wallet; buying or selling on the bonding curve happens in a single transaction. Creating a coin is equally simple: a few clicks in the UI generate a new token contract and bonding pool. The platform prides itself on being “no-code” – founders without any development background can launch in minutes.

For investors, this ease of use is double-edged. On the plus side, everything is transparent on-chain – token stats and trade history can be seen at a glance, and the liquidity/bonding curve mechanics are automatic. On the minus side, the flood of new tokens can be overwhelming. Navigating the list of 10s of thousands of coins requires vigilance. The recent PumpSwap integration has improved UX: all trades (old and new tokens) now happen on the same DEX, and there is a dashboard for creators to track their earnings. For example, Pump.fun added a feature so that token creators can instantly claim their share of trading fees on-chain via their profile. Overall, the UI is bare-bones but functional – it favors simplicity and speed over sophisticated analytics or filtering.

Track Record

Pump.fun’s numbers are staggering, though dominated by fluke wins and many losses. By mid-2025 it had facilitated on the order of 10+ million token launches – more than any rival launchpad on Solana or elsewhere. Transactional volume has been huge: for example, by early May 2025 Pump.fun had seen over $22.3 B in cumulative trade volum. Fee revenue (1% of trades) likewise soared into the hundreds of millions – around $700 M collected by early 2025, at one point topping $3 M per day. These figures made Pump.fun one of the most lucrative DeFi dapps globally.

In terms of standout projects, only a tiny fraction of tokens ever “made it big.” A handful did achieve viral gains: DogWifHat (WIF) is a famous example, which briefly surged past a $1 billion market cap. Likewise MOODENG (a meme-hippo token) hit $170 M in days, and Fartcoin and GOAT even reached ~$1 billion peaks. But these blockbusters are vanishingly rare. Analyses show that only a few hundred thousand of Pump.fun’s millions of tokens ever amass more than trivial liquidity. According to one study, only about 97,000 out of 7+ million tokens ever reached even $1,000 in liquidity – implying 99+% of tokens fade out. One report noted that “only 4 out of ~8.7 million” meme coins ever held a market cap over $100 million. In practical terms, the typical investor’s ROI is negative: most coin launches quickly implode, so pump.fun’s historical returns look like a loser’s lottery.

Cost & Fees

Pump.fun’s fee structure is straightforward but impactful:

Creation Fee: Launching a new token requires a small SOL payment (historically ~0.02–0.1 SOL). This covers the cost of contract deployment.

Trading Fee: Trades on Pump.fun incur a fee (initially 1% on the bonding curve, later lowered to 0.1% after moving to PumpSwap). Importantly, 50% of this fee goes back to the token’s creator. For example, if a coin generates $10 million in trades, the creator would earn $5,000 (0.05% of volume). The platform keeps the remaining half (about 0.05% of volume).

Graduation Fee: Listing a token on an external DEX (like Raydium) required an extra fee (~1.5 SOL). With PumpSwap, listing is built-in so no separate payment is needed beyond normal trading.

Founder Fit

Pump.fun is best suited to bold, low-formality projects, especially pure memecoins and social-driven tokens. Anonymous or pseudonymous founders benefit the most, since no team credentials are needed and identity is discouraged. Teams aiming for rapid community-driven hype (rather than building a product) fit the model: think viral joke tokens or brand-parodies. By contrast, serious startups or tokenized products would struggle here – the platform’s environment (unvetted, unregulated) and audience are misaligned with long-term utility projects.

2. MetaDAO

Platform Overview

MetaDAO focused on futarchy (prediction-market governance) rather than memecoins or NFTs. As its site proclaims, it’s “ICOs, but better,” supporting projects to raise funds and govern via market-driven decision markets. The protocol was founded in 2023 (launched early 2024) as a decentralized DAO experiment. Its team is pseudonymous (led by a developer “Proph3t”) and has attracted top backers: Paradigm led a $2.2M seed round in mid-2024, and other VCs like Pantera and Colosseum have since acquired META tokens.

Supported Launch Models

MetaDAO uses a fixed-supply token sale model with community funding. Project founders define a fundraising goal in USDC; if reached, a pre-set number of project tokens is distributed proportionally to contributors. 10% of funds are automatically allocated to a liquidity pool. There are no auctions or bonding curves – pricing is determined by final funds raised.

mtnDAO’s MTN token used an “uncapped” sale: 10M MTN tokens were issued and the final price was set by (total USDC raised ÷ 10M). 1M additional MTN tokens were minted for liquidity, paired with 10% of the raise

Target Audience & Founder Fit

MetaDAO is tailored to community-driven, governance-focused projects, not quick-hit hype tokens. It benefits teams that want to align incentives with token holders and immediately operate as a DAO. Galaxy Research notes the launchpad “provides an out-of-the-box solution for spinning up a DAO and token, projects get capital raised and a community established before token generation”.

Accordingly, MetaDAO appeals to builders of long-term protocols and DAOs, rather than memecoin entrepreneurs. Founders must be willing to cede control: notably, mtnDAO’s founders publicly committed to no reserved token allocation for themselves – “if they want it, they’ll need to buy it; there’s no airdrop or founder allocation”. In practice, projects on MetaDAO are shaped by traders (“traders with big bags”) placing bets, not by a central team.

Investors best suited to MetaDAO are those seeking active, prediction-market participation – essentially “smart investors” who want direct influence through trading, rather than passive token holders.

In short, MetaDAO is ideal for founders and investors who value decentralized decision-making and long-term alignment.

Project Vetting & Curation

MetaDAO’s vetting is largely community-driven. The platform’s launchpad was itself approved via a futarchy vote (a “Release a Launchpad?” proposal was put to the DAO and passed).

Early on, only curated projects were allowed, but the vision is to eventually open it up. There is no central gatekeeper or KYC process beyond this; instead, any project that gets a nod from the DAO can launch.

Importantly, decisions are transparent and on-chain: the DAO community votes by trading on proposals. For example, MetaDAO lists all active and completed proposals (like “Buyback MTN with 1.5M USDC?” or “Launch islSOL token?”) on its website.

This means the community effectively vets initiatives post-launch as well. Even feature-requests are futarchic: a proposal to develop a “memecoin launchpad” on MetaDAO was openly voted on and was rejected by traders.

Tokenomics & Vesting Structure

MetaDAO emphasizes clarity and community control in tokenomics. Its own governance token ($META) was initially minted as 1,000,000 total: 10,000 were airdropped to early wallets and 990,000 held in the DAO treasury. Crucially, 979,000 of those tokens were later burned by vote, permanently capping supply at 21,000 META.

These changes were all done via futarchy proposals – for example, the March 2024 burn was a community decision This means no secret allocations or founder shares; all META supply changes are on-chain and approved by the DAO. Projects launching on MetaDAO follow similar principles. Notably, mtnDAO’s founders voluntarily took 0% token allocation for themselves in that token launch. If anything, tokenomics can be tailored by DAO governance: for example, one MetaDAO community voted to impose a 3-week vesting on its own DAO payments.

UX & Investor Experience

The MetaDAO interface is a clean web app requiring a Solana wallet connection. Users land on sections like “Launches” and “Decisions,” and can easily swap between contributing to projects and trading outcomes.

For example, the mtnCapital launch page guides users to “Connect your wallet to view and claim your tokens” and displays funding progress, illustrating an intuitive flow. The “Decisions” tab lists proposal markets, giving traders a transparent view of vote status. No mobile app is launched yet; it relies on standard wallet integration.

All crucial data (volumes, token prices, outcomes) are public and updated in real time. As a Solana dApp, on-chain reliability depends on Solana’s network health, which has been solid. The design is minimalist but functional – it may be complex for newcomers due to the futarchy concept, but for experienced users the process is clear. In summary, MetaDAO offers a no-frills, developer-grade experience: connecting a wallet and transacting is seamless, and all actions are transparently recorded on-chain.

Community & Ecosystem Strength

MetaDAO’s community is active but niche. It lives primarily in the Solana ecosystem, appealing to developers and traders interested in DAO governance. Several major Solana projects have adopted it for governance: Galaxy Research reports that 62 futarchy markets have run on MetaDAO across nine DAOs since late 2023. High-profile users include Sanctum (4 decisions with 1,648 voters) and staking protocols like Jito and Marinade. This shows growing developer engagement.

Total trading volume since v2 is modest (about $2.26M across 10k+ swaps), reflecting a small but committed user base. Active discussion happens on Social media, though exact membership counts are not public. The token social footprint is relatively low-key.

Post-Launch Support

MetaDAO provides some built-in support but not in the traditional accelerator sense. Upon funding a launch, the platform automatically creates liquidity: 10% of the raised USDC is paired with tokens in an on-chain pool (this helps ensure immediate market liquidity). All remaining funds are locked in the DAO treasury, so any project expenditures (development, marketing, etc.) must be proposed and approved through futarchy.

Beyond this, MetaDAO does not overtly manage listings or promotions. Projects rely on their communities to drive adoption. On the positive side, being a MetaDAO launch means inheriting a community of engaged traders and builders; for example, the mtnCapital token gained early credibility by raising within the Solana hacker community. There’s no formal marketing package, but the shared DAO infrastructure is a form of incubation – the community helps govern, which can align marketing/incentives.

Pros & Cons Summary

Advantages

MetaDAO offers a novel, highly aligned launch environment. It ensures fairness (100% of funds on-chain, founder has no hidden allocation), provides immediate liquidity for tokens, and embeds projects in a ready-made community. For serious DAO or infrastructure projects, this is ideal – capital raising comes with built-in governance and a committed user base. It solves the “capital vs. trust” paradox by locking funds and requiring community agreement for spending. Token issuance is tightly controlled and transparent (as seen by META’s on-chain burn), aligning interests long-term.

Drawbacks

The model is complex and unproven. Adopting futarchy requires both founders and investors to embrace prediction-market voting, which may deter traditional participants. Setup is slower (launches involve DAO votes) and there are fewer precedents for success – track record is thin. Investor outcomes hinge entirely on community consensus and market speculations, which can be volatile. MetaDAO’s audience is niche (mostly Solana DAOs), so projects targeting fast hype or retail liquidity may underperform. Finally, as with any DeFi platform, smart contract risk and potential oracle issues exist (though MetaDAO has had audits).

Ideal Use Cases

Projects that want community-driven governance from day one – e.g. new DAOs, protocol infrastructure, or on-chain funds – will benefit most. In contrast, a quick viral memecoin (best suited to a bonding-curve pad like Pump.fun) or highly regulated project (better on a KYC pad like Civic) may find MetaDAO’s approach too slow or experimental.

3. DAOS.fun

DAOS.fun is a Solana-based launchpad specializing in decentralized investment. Launched in September 2024, it allows creators to raise SOL and mint tradable “DAO tokens” representing shares in a fund. The platform was developed by a pseudonymous founder known as “baoskee” (with backing from Alliance DAO).

DAOs.fun merges DeFi investment funds with the memecoin craze – retail investors can pool funds under a DAO-manager, and token holders share in profits. It operates in the DeFi/DAO niche rather than NFTs, emphasizing speculative trading (often meme/AI coins) by retail participants. The core team remains small and pseudonymous, so transparency relies on social media updates and public metrics rather than formal leadership disclosures.

Supported Launch Models

DAOS.fun supports one primary launch model: a fixed-target, time-limited fundraise culminating in an on-chain token mint and AMM listing. Creators set a hard cap (in SOL) and a 7-day fundraising window. If the target is met, DAO tokens are minted at a uniform price for all contributors.

Tokens then immediately trade on a built-in virtual AMM (bonding curve), so prices float with demand and fund performance. If the raise fails, contributors may redeem their SOL (minus a 10% penalty fee), ensuring fair launch conditions (everyone pays the same entry price) and penalizing failed raises.

In short, DAOS.fun’s model is akin to a fair-launch IDO for an “investment fund”, rather than a lottery or tiered ICO. There are no separate “private sale” or locked rounds; instead, all investors transact at the one fixed launch price, then trade freely.

Target Audience & Founder Fit

DAOS.fun is aimed at crypto-native meme-traders and degen investors who want exposure to “funds” managed by community or algorithmic strategies. Ideal projects are Speculative DeFi/memecoin funds – for example, AI-driven meme funds or humorous pop-culture DAOs. In beta, new creators need an invitation or referral by existing reputable users. Investor profiles skew retail and speculative: any Solana user with SOL can participate in a raise. The platform democratizes hedge-fund access, letting small holders pool into high-risk strategies.

Access Model & Entry Barrier

Onboarding

To create a fund (become a DAO creator), one currently needs a referral/invite. As of mid-2025, DAOS.fun remains in “private beta” – only wallets invited by Alliance DAO members or the founder can launch DAOs. Once a creator is approved, they connect a Solana wallet, set goals, and raise SOL.

For investors, barriers are lower: any user with SOL and a Solana wallet can contribute to an active raise. There is no native DAOS.fun token required for participation, and no staking prerequisite.

Whitelisting

There is no typical whitelist lottery – raising is first-come, first-served up to the cap. Because funding is capped, some over-subscription may occur but excess funds are likely refunded.

Onboarding UX

The interface is simple (show fund target, countdown, contribute button), but has suffered performance issues under load. High-traffic events (e.g. a major VC shoutout) have crashed the site, meaning newcomers may find it unstable. The founder is reportedly working to hire engineers to improve speed. Overall, the user experience for joining a round is straightforward for crypto-savvy users, but the invitation requirement for creators and occasional site lag are significant hurdles.

Project Vetting & Curation

DAOS.fun curates its creators closely. Every DAO creator must be vetted/invited – the core team (and Alliance DAO associates) screens and refers projects. This referral system aims to prevent outright scams and ensure a minimum quality, though it also means the process is opaque.

In early 2025 the platform explicitly required “trusted creator” references for new funds. There is no public application portal or open IDO listing – funds are hand-picked. The selection process is not fully transparent; projects either receive an invite or not, and there’s little published on criteria. That said, platform leaders have signaled plans to open up vetting via community referral and token-holder voting later. For now, project curation is team-led and invitation-only, relying on internal governance (Alliance DAO and the founder) rather than a broad community vote. This means only certain meme-coin/VC concepts make it through, but those chosen get a trusted platform boost.

Token Distribution Mechanics

Token distribution on DAOS.fun follows a uniform fixed-price sale plus AMM model. During the 7-day fundraising phase, each contributor buys newly-minted DAO tokens at the same price (no tier or tiered discounts). Effectively, tokens are issued on a first-come, first-served basis until the hard cap is reached; every purchaser pays the identical launch price. When fundraising completes successfully, the fund’s tokens become tradable on a virtual automated market maker (bonding curve).

This provides continuous liquidity: as users buy or sell, the bonding curve adjusts price. Importantly, DAOS.fun enforces a price floor at the fundraising level: DAO tokens can only be sold via the AMM if their market price remains above the initial raise price. This limits downside for early investors (they cannot “panic sell” for a loss on the platform; they must wait for redemption).

In fairness terms, all investors share the same launch price and immediate liquidity. There is no lottery or whitelist among contributors – tokens are allocated in proportion to SOL invested up to the cap. If the target is not met, contributors can withdraw (but incur a 10% fee), so no one is stuck in an under-cap fund. After launch, token distribution becomes market-driven: a large portion of supply is held by early buyers, and subsequent trades occur on-chain with price reflecting demand. Because of the bonding curve floor mechanism, the platform balances fairness with speculative upside: investors know they won’t lose principal via AMM trade, while still enjoying any asset upside.

Tokenomics & Vesting Structure

Each DAO on DAOS.fun issues its own DAO token representing shares of that fund. The tokenomics are set per-DAO at launch: typically, all tokens corresponding to the fundraising cap are minted and sold to contributors (e.g. 420.69 SOL raised → a fixed number of tokens distributed at launch).

Creators do not appear to reserve any special allocation of tokens at genesis; instead they earn through fees. Documentation suggests no multi-year vesting – tokens trade freely immediately on the AMM, and all investor tokens are fully liquid (subject to the price floor rule). Founders set their own management fee schedule at creation (for example, a portion of profits) but there’s no centralized tokenomics beyond that.

UX & Investor Experience

DAOS.fun’s user interface is minimalist but functional. Creating or joining a fund involves a few on-chain transactions: connecting a wallet, confirming SOL contributions or trades, and viewing the fund dashboard.

The platform provides real-time displays of fundraising progress, AMM price charts, and token stats. However, performance has been a notable issue. High-traffic events (e.g. celebrity VC shoutouts) have crashed the site, and many users report slow loading times and glitches.

A prominent bug occurred when the $ai16z fund launched – the site showed an absurd AUM (232 billion $NORM instead of ~$3,500) due to a price feed error. These reliability problems have led to frustration among participants. The founder has publicly acknowledged these “tech difficulties” and even sought to hire engineers to improve speed.

Despite these issues, the core UX concept is fairly transparent: every transaction and fund holding is on Solana, so users can verify assets via block explorers. The smart contracts enforce the rules (e.g. token issuance, profit splits), and most metrics (raised SOL, token supply) are visible on-chain. The interface includes clear alerts when a fund’s deadline arrives or when tokens can be redeemed.

Community & Ecosystem Strength

DAOS.fun has rapidly developed an active and hype-driven community, especially on social media. The platform’s memecoin theme attracts the typical “degen” culture of jokes, memes, and viral posts. Project creators and investors frequently announce new DAOs and updates on X and Telegram. Industry influencers have taken note: Marc Andreessen’s public tweets about the AI16Z fund drew major attention and a surge of user interest.

DAOS.fun’s ecosystem is still small by total participants (only dozens of funds exist as of mid-2025), but each fund’s token often develops its own mini-community. For example, $ai16z garnered its own Discord (with users debating with the “AI Marc” persona). The platform has also integrated other projects: e.g. Volhub’s $GOON token was listed as a fund, expanding the network of involved teams. Liquidity in the system can be high – one user quoted DAO tokens showing >10,000 trades per day after hype cycles – which indicates strong active trading.

Track Record & Performance

DAOS.fun’s history (late 2024 to present) features a handful of notable launches with mixed outcomes. The platform hosts on the order of tens of DAOs; reports in late 2024 cited ~20+ live fund tokens. The AI16Z fund is by far the most famous: originally raised 420.69 SOL and quickly spiked to an $470 million market cap (according to some reports) before crashing amid team errors. Another example is Kotopia DAO, which raised over 4,207 SOL ($740,000) in its first days. Smaller funds (like “Sequoia” pun funds) have surfaced too.

In terms of ROI and capital flows: participants have seen spectacular if volatile returns. For instance, one investor put 20 SOL (~$3,500) into ai16z tokens and later held a position worth $2.3 million (a ~650× gain). Many early investors on AI16Z and similar funds recorded triple- or quadruple-digit percent returns when token prices soared.

However, these runs were extremely short-lived; ai16z gave back most of its value after governance missteps, and by 2025 its market cap had fallen into the tens of millions. Other funds have been less explosive – for example, Sequoia-themed DAOs saw modest volume and little price movement. Quantitative metrics are limited, but CoinGecko/coinrank tools reported the entire DAOS.fun ecosystem at ~$45 million market cap in early 2025 (down ~26% in 24h), suggesting most capital is concentrated in a few big funds.

Post-Launch Support

Once a fund’s raise completes, DAOS.fun provides built-in listing and liquidity via its AMM. There is no need for a separate exchange listing – tokens are automatically tradeable on the platform’s virtual AMM immediately after minting. Liquidity is effectively provided by the bonding curve mechanism (the raised SOL and minted tokens anchor the AMM pool). Founders do not need to supply additional liquidity; the contract ensures a continuous market as long as there is trading volume.

Governance & Decentralization

DAOS.fun itself is team-governed, not a decentralized DAO. There is no publicly traded governance token for the platform, and major decisions (roadmap, vetting, upgrades) are made by the founder and core team (including Alliance DAO stakeholders) through social media and internal discourse. In mid-2025, the team hinted at introducing more community governance (e.g. a token-holder voting module), but as of now the platform’s treasury (fees) and future direction remain centralized. The only tokenomics to speak of are the individual DAO tokens for each fund.

Ideal Use Cases

DAOS.fun is best for risk-tolerant, meme/crypto-savvy participants. Projects that are community-driven, DeFi-focused or AI/meme-themed fit well. It’s ideal for creators who want to launch a fun, speculative “venture fund” without dealing with regulators or venture firms. Investors should be prepared for roller-coaster price action and use DAOS.fun as a high-upside gamble rather than a traditional investment. For mainstream or regulated ventures, a different platform would be more suitable.

4. Solanium

Platform Overview

Solanium is a premier Solana-native fundraising launchpad and integrated DEX. Founded in 2021 in Amsterdam, it has backed around 60 projects raising over $18M. The platform is DeFi-focused, combining token fundraising with an on-chain swap and native wallet support. Users stake the native $SLIM token to earn governance tokens (xSLIM) for IDO access. The team, led by experienced blockchain entrepreneurs, emphasizes usability and community governance. Solanium’s backers include KuCoin, CoinEx, gate.io, and MEXC, reflecting strong ties to the wider Solana ecosystem.

Supported Launch Models

Solanium exclusively hosts Initial DEX Offerings - IDOs on Solana. It does not use bonding-curve or “fair launch” models; instead each token sale has a fixed price set by the project.

For example, the Solice IDO sold $SLC tokens at a fixed price of 0.07 USDC. All sales are managed via tiered staking: participants must hold xSLIM (earned by long-term SLIM staking) for access.

This “time-weighted staking” model incentivizes long locks. KYC/whitelist rounds precede each public sale. Solanium offers one main sale round (public IDO) with a lottery and guaranteed portion depending on tier – there are no continuous bonding curves or automatic pools.

Target Audience & Founder Fit

Solanium is best suited for established Solana projects and experienced DeFi teams. It particularly fits DeFi protocols, gaming/NFT projects, and infrastructure tools seeking committed, long-term token holders. Founders benefit from Solanium’s deep Solana community and marketing reach (reportedly ~80K+ members per launch).

The investor profile is correspondingly professional: participants are typically veteran Solana users who can stake large SLIM amounts. As one analysis notes, Solanium delivers a “quality investor base” and filters out short-term flippers. Beginner projects or casual traders are less of a fit: the platform’s multi-step staking/whitelist system and emphasis on due diligence mean it favors teams and backers who value discipline and security over simplicity.

Regulatory & Legal Requirements

Solanium enforces standard KYC/AML and jurisdiction checks. All participants must complete KYC (via the Synaps identity provider) to join any whitelist or sale; this is a one-time process per wallet. Projects and sales also carry disclaimers: by default sales are not open to U.S. or Chinese investors (and often other restricted countries).

Access Model & Entry Barrier

Whitelist access proceeds in two pools: Tier-holders vs Community. Tier holders (higher xSLIM) enter a guaranteed allocation pool; others enter a lottery-based pool after completing social tasks. Aspirants must link their wallet to Telegram and perform tasks (like, Twitter likes, referrals) to earn lottery “tickets”. Whitelisting is highly competitive: projects often receive thousands of applications. In practice the main barriers are high: substantial SLIM stake or extensive social activity, plus the time-lock on stake.

Project Vetting & Curation

Solanium uses a team-plus-community curation model. Every new project undergoes a core-team interview and technical/legal check first. Approved projects must then be voted on by the community via Solanium’s on-chain Governance Program. In effect the community provides final due diligence: SLIM/xSLIM holders vote on whether to launch the token.

The platform highlights that “projects featured on Solanium are carefully curated with a thorough due diligence process”. This dual screening (internal audit + public vote) is intended to filter out poor or scam projects. All IDO details (whitepaper, vesting schedule, etc.) must be transparently published in the project page during vetting. In summary, curation is semi-centralized (team-led interviews) with an on-chain democratic check (community voting), rather than open-listing any submission.

Token Distribution Mechanics

Solanium allocates sale tokens via a tiered lottery and guaranteed system. After whitelisting, winners are drawn in a hybrid model: Tiers 1–3 participate by lottery and may receive an allocation (with tier-specific odds), while Tiers 4–5 get guaranteed allocation every time. Each tier earns a number of lottery “tickets” proportionate to its xSLIM.

For example, 100 xSLIM grants 1 ticket, 1,000 xSLIM gives 12 tickets, 5,000 xSLIM gives 100 tickets. Social pool entrants also get tickets from tasks/referrals. At sale time, the pool of sold tokens is split between lottery winners and guaranteed slots.

In a past sale (160,000 USDC), Tier 1 had a 15% win rate, Tier 2 ~30%, Tier 3 ~90% (unlocked), while Tier 4–5 got 100%. This model is designed for fairness: higher tiers lock more but have higher success odds, while lower tiers must “win” a lottery. Unclaimed tokens can be airdropped or re-offered.

Tokenomics & Vesting Structure

The Solanium ecosystem runs on two tokens: SLIM (utility) and xSLIM (governance). SLIM has a 100M max supply: 25% to community, 20% team, 5% public sale, 5% seed, 15% private sale, 5% advisors, 25% foundation. SLIM holders can stake up to 1 year to earn non-transferable xSLIM, which grants IDO access and governance votes. As for launched projects, they typically use locked vesting schedules.

UX & Investor Experience

Solanium’s user experience is generally praised as smooth and modern. The team stresses good UI by design. The Web interface is wallet-friendly (supporting Phantom, Solflare, etc.) and includes tutorials for beginners. Solanium also provides integrated tools: a native DEX UI (with a custom Serum frontend in development) and staking dashboards. Investors track xSLIM balances and whitelists in real time.

Community & Ecosystem Strength

Solanium has built a sizeable Solana community. According to on-chain data, over 400K addresses hold SLIM (around 40M SLIM staked). Across dozens of IDOs, some 72,000 participant slots were filled. Community outreach is strong: marketing claims of 80K+ members reached per IDO. Social channels are active, with frequent updates. User sentiment online is generally positive. In ecosystem terms, Solanium sits at the core of Solana fundraising: it supports NFT, GameFi and DeFi projects alike. Compared to other Solana pads, Solanium ranks among the most well-known, though it is less meme-centric (focus is on quality project launches).

Track Record & Performance

Solanium has a solid track record on Solana. It has hosted dozens of IDOs – roughly 42 by late 2023 and 60 by 2025 – raising more than $18 million in aggregate. Top past projects include Port Finance, Cyclos and CropperFinance, which delivered strong gains for early investors. Data aggregators report typical 6-month ROI of 2.2× on Solanium IDOs (ath ROI 7.5×).

One analysis notes a minimum ROI of 1.4× across launches (with many individual IDOs returning 10×–100×). In short, Solanium’s launches have tended to outperform average market moves, though (as always) results vary by project. Its reputation is that of a “leading traditional IDO platform” on Solana, and several projects from Solanium rounds have since listed on major exchanges or continued to grow.

Post-Launch Support

After the IDO, Solanium provides ecosystem support. Every funded project can easily deploy a liquidity pool on Solanium’s DEX (or Serum) via the platform’s pool manager. In fact, Solanium offers a no-code pool creation UI (even minting a new SPL token) for token listing.

The team also helps with marketing and exchange introductions: founders get access to Solanium’s network of investors and may receive assistance with cross-listings. Governance‐wise, new tokens often get xSLIM voting privileges so holders can influence future unlocks or community decisions. Looking ahead, Solanium is building custom Serum GUI tools to further aid trading and analytics.

Governance & Decentralization

Solanium is not a fully permissionless DAO, but it incorporates token governance. Its xSLIM token acts as a governance right: holders can vote on Solanium proposals and project launches. The launchpad’s fee model is partly decentralized: a cut of swap fees is paid out to xSLIM stakers and a treasury.

This means active stakers help govern operations and have a financial stake in the platform’s success. However, core decisions (adding support, partnerships, treasury use) are still made by the core team.

Cost & Fees

Using Solanium is relatively low-cost for participants. Investors pay no explicit “entry fee” beyond acquiring SLIM for staking and the minimal Solana network gas (typically <$0.01 per TX). Projects pay launch fees: industry estimates put Solanium’s platform fee around 2–5% of funds raised.

There are also standard listing locks – e.g. mandatory liquidity locks are often required for at least several months. Overall, costs are on par with comparable Solana IDO platforms: significant token commitment on entry, modest percentage fee on exit, and tiny chain fees.

Pros & Cons Summary

PROS

Solanium’s main strengths include a professional investor base (committed stakers, few flippers) and a strong community. Its multi-layer vetting and staking model mean projects tend to be higher-quality and holders more invested. The platform provides end-to-end support: full KYC/compliance, custom smart contracts, and marketing reach (80K+ community per IDO). UI and integration are top-notch (wallet ease, tutorials), and Solana’s speed makes the experience smooth. Track records show solid ROI and many success stories from its IDOs.

CONS

Barriers to entry are high, participants need to stake lots of SLIM (and lock it) to get meaningful allocations. The process is relatively complex (whitelists, tasks, multiple steps), which can deter casual users. Only a limited number of launches are hosted, so projects face competition to get in. Legally, U.S. and some other users are excluded, and all users must pass KYC, which may limit “anonymous” investors.

Ideal Use Cases

Solanium is ideal for serious Solana projects (DeFi, gaming/NFT, infrastructure) looking for a well-vetted fundraising round, and for experienced crypto investors who value governance and long-term staking over quick flips. It is less suitable for unproven teams or casual traders.

Chapter 4: Choosing the Right Launchpad

While comparative analysis offers a structured overview of various platforms, the actual decision of choosing a launchpad is inherently contextual. Each project carries its own set of technical, regulatory, and strategic requirements, so the ideal platform must be evaluated through the lens of that specific initiative.

To ground this in practice and offer a clearer understanding of how to approach this decision, the following section walks through a hypothetical case study. This fictional example is constructed solely for educational purposes to demonstrate how founders might assess launchpad fit based on their project’s needs, values, and roadmap.

Case Study: VN Protocol (VN) - Hypothetical Project

VN Protocol is a simulated, early-stage governance infrastructure project built on Solana. Its core offering is a modular toolkit that allows DAOs to manage proposals, contributor incentives, treasury decisions, and permissioned workflows. Designed for composability and ease of use, it draws inspiration from platforms like Nouns DAO and Charmverse, but is native to Solana’s developer stack.

The fictional founding team consists of pseudonymous contributors with visible GitHub histories and prior involvement in Solana hackathons. While they remain semi-anonymous, their technical credibility is established within niche dev circles. At the time of this hypothetical launch, they have no venture backing and are looking to execute a public-first raise.

Their fundraising goal is modest between $300,000 to $400,000 with no intention of private sales or VC preallocations. The aim is to allocate tokens to long-term aligned holders through a fair launch mechanism. The MVP is already live on devnet, audited, and tested by two DAO communities. Documentation is public, and early community members have begun engaging via Discord.

Importantly, the team does not wish to impose strict KYC, given its mission to empower grassroots communities globally. While it accepts basic wallet filtering or anti-bot measures, the emphasis is on maintaining accessibility for contributors across regions. Beyond capital, the team seeks structured DAO onboarding, governance support, and treasury design mentorship in the post-launch phase. They are prepared to undergo a multi-week launch timeline and prefer to avoid platforms that overly prioritize hype over durability.

Evaluating Fit

Based on this profile, several popular Solana launchpads would not be appropriate. Pump.fun, while active and effective for meme tokens, is optimized for virality and low-friction launches—an unsuitable match for a governance protocol seeking long-term sustainability. Magic Eden’s Launchpad, though professional and widely recognized, leans heavily toward NFTs and curated token sales. Its onboarding rigor, institutional standards, and strong KYC requirements create friction for semi-anonymous teams with no prior listings or VC associations.

Daos.fun offers a radically open alternative but lacks the necessary infrastructure for a structured, technically sophisticated protocol launch. Similarly, newer entrants like Coinchef or Believe may offer flexibility, but their support systems, community quality, and governance tooling are either immature or untested at scale.

MetaDAO, however, stands out as a strong alignment. It supports founder-led projects with real technical depth and community-first principles. MetaDAO’s model allows semi-anonymous teams to launch responsibly without the friction of full KYC compliance. It offers flexible token sale configurations, including bonding curves and modular pricing models. More importantly, it embeds post-launch support for governance formation, contributor incentives, and long-term treasury planning. Its orientation toward public goods, DAO tooling, and onchain transparency make it a natural fit for a project like Collective Protocol.

The Decision

After evaluating all relevant platforms, VN Protocol would likely proceed with MetaDAO. Not because it is the largest or most high-traffic platform, but because it is architected for precisely this type of project: technically capable, community-oriented, governance-aligned, and public-first.

In a market crowded with launch options, the most meaningful differentiation lies not in token prices or exposure—but in shared values, aligned incentives, and readiness for long-term decentralization. MetaDAO’s positioning reflects this understanding, and for builders like the team behind Collective Protocol, it represents not just a launch platform—but an early institutional partner.

Conclusion

This report dissected the evolution of crypto fundraising, explained why launchpads emerged, and compared Solana’s top platforms across technical, economic, and governance dimensions. It outlined the strengths and trade-offs of each model for both founders and investors. Ultimately, it’s a practical guide to understand increasingly complex launchpad ecosystem, where launchpads are not just fundraising tools, but critical infrastructure which is shaping the future of decentralized innovation.

Spending time researching and comparing these launchpads left me more informed, but also more cautious. The space is noisy, fast-moving, and often dominated by short-term metrics. It was challenging to filter signal from hype. What stood out most was how fragmented the experiences can be for both founders and investors. Writing this helped me understand that choosing a launchpad isn’t just a technical or financial decision, it’s a strategic one, shaped by what you’re willing to prioritize and compromise on.